The 2024 tax reference guide provides essential information and tools for navigating tax season, including federal income tax rates and quick reference guides for personal income and capital gains taxation purposes online.

Tax Season Overview

The tax season for 2024 is underway, with the IRS starting to accept and process tax returns on January 27. This filing season will continue, and it is essential to be prepared with the necessary documents and information. A step-by-step guide is available to help individuals figure out what they need to file their tax return, especially for those doing it for the first time. The guide provides an overview of the tax season, including important deadlines and requirements. It also explains how to maximize refunds and take advantage of available tax credits. Additionally, the guide offers tips on how to avoid common mistakes and ensure a smooth filing process. By understanding the tax season overview, individuals can better navigate the complexities of tax filing and make informed decisions about their tax strategy. The guide is a valuable resource for anyone looking to stay on top of their taxes and make the most of their refund.

Understanding Tax Brackets

Tax brackets are ranges of income that are taxed at specific rates, with rates increasing as income rises, affecting personal income and capital gains taxation purposes.

Federal Income Tax Rates

Federal income tax rates are a crucial aspect of the tax system, with rates ranging from 10 to 37 percent, depending on income level and filing status. The rates are applied to taxable income, which is calculated by subtracting deductions and exemptions from gross income. The 2024 tax reference guide provides detailed information on federal income tax rates, including the tax brackets and rates for single and joint filers. The guide also explains how to calculate taxable income and apply the tax rates to determine tax liability. Additionally, the guide covers other aspects of federal income tax, such as tax credits and deductions, to help individuals and businesses navigate the tax system and minimize their tax liability. By understanding federal income tax rates and how they are applied, individuals and businesses can make informed decisions about their tax planning and strategy. The guide is a valuable resource for anyone looking to understand the tax system and stay compliant with tax laws and regulations.

Tax Planning and Reference Guides

Tax planning and reference guides provide valuable resources for navigating tax season and minimizing liability with expert guidance and tools online available now everywhere instantly.

Quick Reference Guides

Quick reference guides are essential tools for navigating the complexities of tax season, providing users with a concise and easily accessible source of information on tax rates, deductions, and credits. These guides are designed to offer a summary of key tax concepts and rules, allowing individuals to quickly reference and understand the information they need to make informed decisions about their taxes. The 2024 tax reference guide includes a range of quick reference guides, covering topics such as federal income tax rates, capital gains tax, and tax credits for individuals and families. By using these guides, taxpayers can ensure they are taking advantage of all the tax savings available to them and avoiding costly mistakes. Additionally, quick reference guides can be used by tax professionals to help their clients understand the tax implications of different financial decisions and to identify potential tax savings opportunities. Overall, quick reference guides are a valuable resource for anyone looking to navigate!

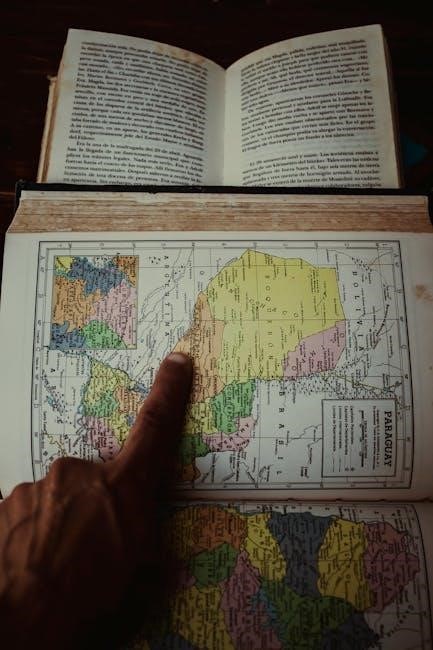

Foreign Income and Taxation

Foreign individuals use Form W-8BEN to document foreign status and claim treaty benefits for chapter 3 purposes with specific guidelines online always available for reference purposes only.

Foreign Status and Treaty Benefits

To claim foreign status and treaty benefits, individuals must submit Form W-8BEN, which certifies their foreign status and eligibility for reduced tax withholding under a tax treaty. The form requires specific documentation, including a valid passport and proof of foreign address. Foreign individuals should consult the IRS website for detailed instructions and guidelines on completing the form. Additionally, they can refer to the 2024 tax reference guide for information on tax treaties and foreign tax credits. The guide provides an overview of the tax implications of foreign income and the benefits of claiming foreign status. By understanding the rules and regulations surrounding foreign status and treaty benefits, individuals can ensure they are in compliance with tax laws and taking advantage of available tax savings. The 2024 tax reference guide is a valuable resource for navigating the complexities of foreign income taxation.

California State Tax Withholding

California state tax withholding requires manual or electronic computation of allowances using specific guidelines and formulas provided online for accurate tax calculations and compliance purposes only.

Computing Tax Withholding Allowances

Computing tax withholding allowances is a crucial step in the tax preparation process, and the 2024 tax reference guide provides detailed instructions on how to do so. The guide outlines the specific formulas and guidelines to follow for manual or electronic computation of allowances. According to the guide, individuals can use the provided tables and charts to determine their correct withholding allowances. The computation process involves several steps, including determining the individual’s filing status, number of dependents, and other relevant factors. The guide also provides examples and illustrations to help individuals understand the computation process. Additionally, the guide notes that individuals can use online tools and resources to help with the computation process. By following the guidelines and instructions provided in the 2024 tax reference guide, individuals can ensure accurate computation of their tax withholding allowances and avoid any potential errors or penalties. The guide is a valuable resource for anyone looking to navigate the tax preparation process with ease and confidence.